Authenticate your Deed of Extrajudicial Settlement of the Estate

Are you a Filipino living abroad with deceased parents with property in the Philippines being left behind? Are you an heir to a Filipino relative with real estate that requires title transfer or settlement of estate? Do not fret, as your being away from the Philippines should not hinder you from being able to transfer the properties from your deceased parents (or grandparents if your direct descendants are likewise deceased) under your and your siblings’ name. Let us walk you through the ways on how you can process the settlement of your relatives’ estate if you are a Filipino living abroad through the apostille process of extra judicial settlement.

Securing the Services of a Broker

One way of speedily facilitating the sale of your relatives’ estate is by enlisting the services of a broker. For that to come into fruition, a contract of agreement must be signed between the two parties- the owner and the broker. Before discussing the terms and conditions of the contract, the broker shall make sure that all the public or private documents of the seller are in order, such as if the land title of the real estate to be sold is devoid of any encumbrances, liens, and loans. After which, the terms and conditions of the sale and the broker’s fee shall be finalized.

An authority to sell shall be issued thereafter by the owner, which stipulates the limits of the authority given to the broker- whether there is an exclusive or non-exclusive right to sell the estate at hand, thus binding the broker in an agent capacity. Beside the authority to sell, a separate letter of authority shall be issued by the owner wherein the broker shall have the capacity to get the corresponding certified true copies of the tax clearance, tax declaration, and land title.

If a buyer is interested in purchasing the property, a letter of intent shall be issued by the buyer, declaring his or her intention to purchase it. If the seller accepts the letter of intent of the buyer, he or she shall sign it, thus binding him or her to not offer the estate to another. After which, an earnest money shall be given by the buyer until the balance of the amount to be paid shall be completed.

It is important also to take note that providing a Special Power of Attorney or SPA if you plan to o handle the distribution or transfer of assets in the Philippines on your behalf without traveling. An SPA is a necessary legal document for your representative or agent to be able to act on your behalf. This is a notarized document by the Philippine notary public.

Extrajudicial Settlement of Estate with Deed of Sale

Considering that this property for sale is originally a property of deceased person, and the ones selling the estate or real property are the heirs, it is necessary that the heirs execute an Extrajudicial Settlement of Estate with Deed of Sale. This legal document is used to settle the estate and/or sell the inherited property.

Note, however, that the pertinent taxes such as the estate tax, capital gains tax or creditable withholding tax, documentary stamp tax, transfer tax, and registration fees must also be paid as well to fully transfer the estate from the seller to the buyer.

You already have the Extrajudicial Settlement of Estate with Deed of Absolute Sale, does that mean that the document is already binding? Not yet. For the Extrajudicial Settlement of Estate with Deed of Absolute Sale to be binding, it must then be notarized for it to become a public document. What is the significance of notarizing the Extrajudicial Settlement of Estate with Deed of Absolute Sale? This serves as a protection from future claims of third persons, as well as fraud.

The seller’s obligation does not end with the signing of the Extrajudicial Settlement of Estate with Deed of Absolute Sale. To smoothly transition the real estate from the seller to the buyer, the sellers or heirs must give the original copies of the transfer of certificate of title or condominium certificate of title, as well as the tax declaration and tax clearance to the buyer. The buyer then has the obligation to get a new tax declaration thereafter so that all the documents as to ownership of the property sold (and bought) are transferred entirely to the buyer’s name.

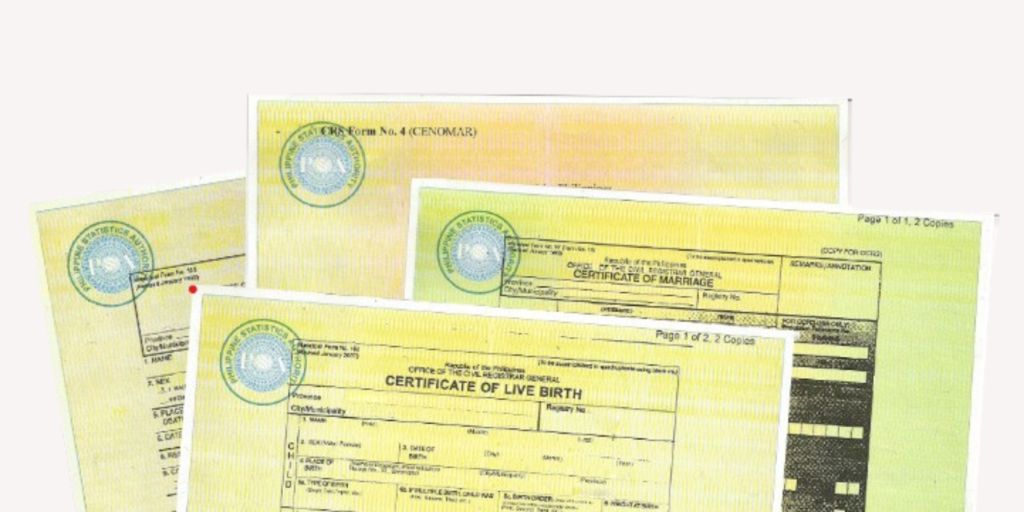

Get an Apostille in the Philippines

To be able to use public documents issued in the Philippines to abroad, an apostille certificate shall be issued by the Department of Foreign Affairs (DFA). Official documents, such as legalized real estate property contracts or deeds need only to be apostilled as the red ribbon process of authentication no longer applies for states that are party to the Apostille Convention.

The settlement of estate, however, does not stop with the apostille of the extrajudicial settlement of estate (in this case extrajudicial settlement of estate with sale), the buyer or seller must still process the BIR CAR.

Need further information and assistance in Extrajudicial Settlement of Estate with Deed of Sale? Talk to our team at FILEDOCSPHIL to know more about the requirements and process. Call us today at (+63) 917 149 2337 or send an email to info@filedocsphil.com for more information.