In the Philippines, many vehicles are being acquired through loans, which means a lot of them are encumbered. After the full loan payment, transferring ownership of a motor vehicle with an existing chattel mortgage involves a legal process, wherein the borrower needs to process the annotation and cancellation of mortgage and get their name placed as the owner of the vehicle.

This article will guide you by providing a comprehensive overview of the process, including the requirements needed, and how to properly cancel the chattel mortgage with the Registry of Deeds (RD) and Land Transportation Office (LTO).

If you’re looking for a hassle-free way to handle annotations and cancellations, FileDocsPhil is here to assist.

Cancellation of Chattel Mortgage in Motor Vehicle Transactions

A chattel mortgage is a loan agreement where the vehicle serves as collateral for financing. This means that until the loan is fully paid, the lending institution holds a legal claim over the vehicle.

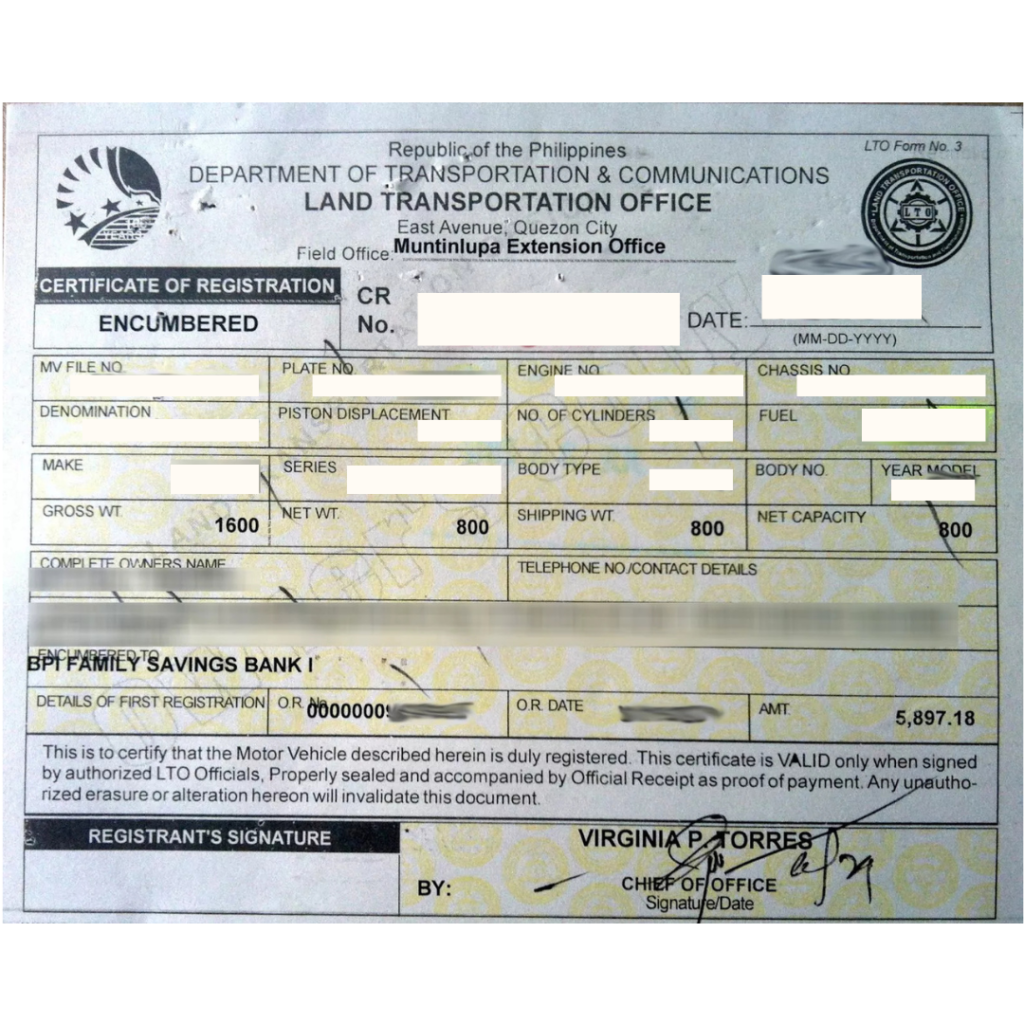

Vehicles that are bought through lending institutions or banks are issued a Certificate of Registration Encumbered (CRE) which indicates that the lender is the owner of the asset, not the buyer, until such time that the loan has been fully paid.

Once the buyer has fully paid the loan, then it is the only time that their name will be placed as the owner of the vehicle. Before transferring ownership, the chattel mortgage must be canceled and properly annotated. Making the CRE change to a regular LTO Certificate of Registration (COR) without the “Encumbered”.

To check if the vehicle is encumbered, just simply check the Certificate of Registration, and if there is an annotation on it saying that it is encumbered, the vehicle was acquired with a chattel mortgage and hasn’t been paid in full.

Certificate of Registration Encumbered (CRE)

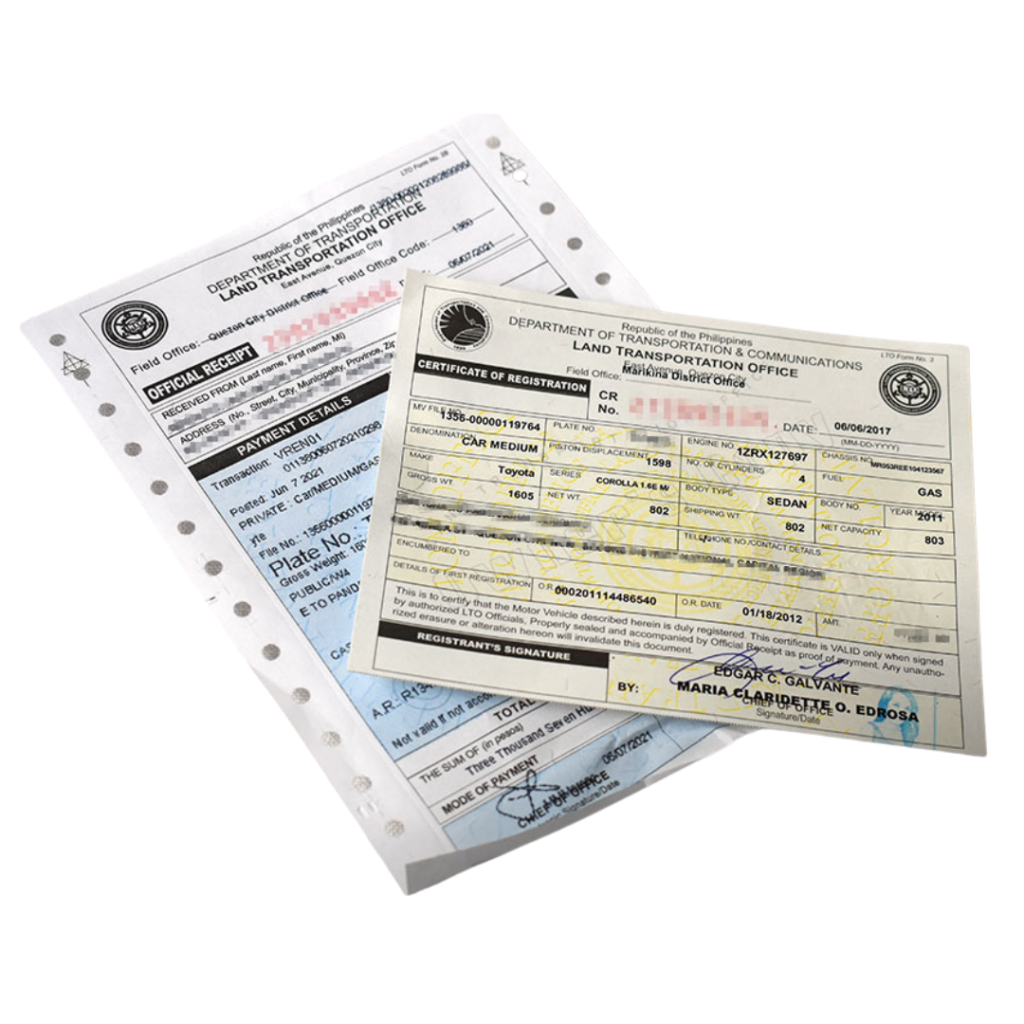

Certificate of Registration (CR/COR) and Official Receipt (OR)

Requirements for Filing an Annotation and Cancellation of Chattel Mortgage

Cancellation of Mortgage is done at the Registry of Deeds and for filing the annotation and cancellation of Chattel mortgage can be done at the LTO. But keep in mind that you must process these on the designated RD and LTO Office or branches where the mortgage and CR is registered.

Here are the documents that you need to prepare when processing annotation and cancellation of chattel mortgage.

Original and a photocopy of the loan contract

Chattel Mortgage Form

Two (2) Valid Government-issued ID from the registered car owner

Taxpayer’s Identification Number (TIN)

Original Certificate of Registration (CR) of the vehicle

Latest original and photocopy of the Official Receipt (OR) of payment for the vehicle

Chattel Mortgage contract duly-annotated or stamped by the Registry of Deeds

Original Registered Promissory Note with Chattel Mortgage

Two (2) copies of the Release of Chattel Mortgage

Motor Vehicle Inspection Report (MVIR)

Confirmation of CR/OR (CIR-91-137) if issued by other LTO Agency

Common Steps on Transferring Ownership of Vehicle with a Chattel Mortgage

When your loan is fully paid, these are the steps on how you can file for annotation and cancellation of Chattel Mortgage:

Step 1: Conduct Due Diligence

Ensure that the registration of your vehicle is up-to-date and there are no pending penalties or violations. Don’t forget to check all the documents that you have for any discrepancies.

Step 2: Ensure Complete Documentary Requirements

Prepare all the required documents, especially documents from the bank. Make sure to have a photocopy of each document for record-keeping and submission. Other documents may need to be notarized.

Step 3: Go to Registry of Deeds

Once you have your documents, go to the Registry of Deeds where the mortgage was registered. You should see this in the stamp on the original Registered Promissory Note with Chattel Mortgage or in the original CR under the space for RD.

You will need to submit the following documents at the RD:

Original Registered Promissory Note with Chattel Mortgage

Release of Chattel Mortgage

One (1) copy of your two (2) Valid IDs

Processing time for the cancellation of the mortgage in RD depends on the branch and whether the person will sign is present at the time. It usually takes 1-3 days.

You’ll receive an official document for the Cancellation of Chattel Mortgage and may now proceed to the LTO branch to have it removed from your vehicle’s CR.

Step 4: Go to the Land Transportation Office

After processing the cancellation of the mortgage at the RD, you may now proceed at the designated LTO branch for the cancellation of encumbrance. You’ll be submitting the following documents:

Release of Chattel Mortgage (duly stamped by the Registry of Deeds)

Official Receipt of the payment of Cancellation.

After these documents are submitted to the evaluators, you may now proceed to the actual inspection of motor vehicles with a duly accomplished MVIR. After this pay all the necessary fees and obtain an OR.

Step 5: Release of New Certificate of Registration

After the payment of fees in the LTO, you must surrender the Original Certificate or Registration with Encumbered (CRE) and wait for a personnel to print a new CR without the “Encumbered”.

Proceed to the Releasing counter and obtain the new CR, plates, sticker, and other requested documents.

Sound’s Overwhelming? It doesn’t have to be!

Processing a chattel mortgage cancellation and ownership transfer can be time-consuming and tedious. FileDocsPhil simplifies the process for you by:

Handling document retrieval and submission at the Registry of Deeds and LTO.

Ensuring correct annotation and cancellation of the chattel mortgage.

Guiding you through each step, avoiding unnecessary delays.

Assisting in processing requirements for a seamless transaction.

Let FileDocsPhil Do the Work!

Need further information and assistance in Cancellation and Annotation of Chattel Mortgage?